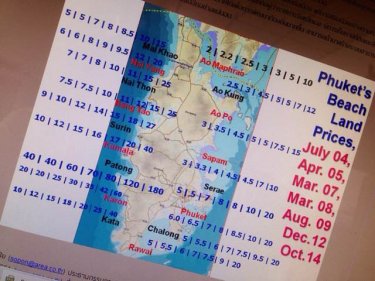

Property consultants the Agency for Real Estate Affairs say that the average price per rai on Phuket rose 384 percent in that remarkable decade.

Patong on the holiday island's popular west coast was the leader with the price per rai zooming up from 40 million baht a rai in 2004 to 180 million baht a rai in 2014.

According to AREA's Dr Sopon Pornchokchai, the boom is likely to level off in 2015.

''Those kinds of rises are unsustainable,'' he said. ''The political front and the lacklustre Euro are likely to see a levelling.

''But if Phuket gains self-government and improved infrastructure, we could see another growth spurt at any time.''

Unsurprisingly, Phuket's west coast, with its beaches and resorts, is more pricey than the up-and-coming east coast with its better seascapes.

As for the tsunami, Dr Sopon believes it had no real effect on property prices because buyers are confident it was a once-in-100-years event.

Property prices in Thailand are indeed unsustainable. Brought about by the influx of tourists and parasitic property developers and estate agents, driving up the prices even further for a quick profit. Similar patterns have also emerged from the UK (as an example), where foreign investors are allowed to buy a property in the same manner. Needless-to-say, many dwellings lay uninhabited, sold at a profit and the investor is never to be seen. One wonders if the government will ever step in to end this madness?

Thailand seems to be doing the same, and this increase has a dramatic effect on the locals, who unfortunately cannot afford to buy property in their own country.

Of course what comes up, must eventually come down. It's not a matter of if, but when.

Posted by reader on December 30, 2014 05:47